TX 11.251 2013-2026 free printable template

Show details

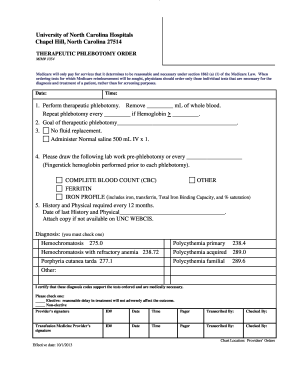

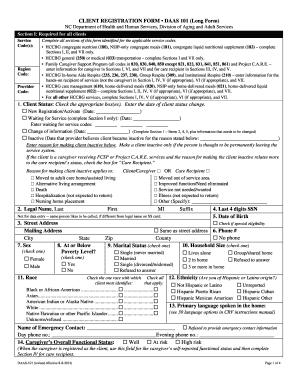

Harris County Appraisal District Business Industrial Property Division P. O. Box 922007 Houston TX. 77292-2007 713 957-5607 Form 11. 251 01/2013 Application for Exemption of Goods Exported from Texas Freeport Exemption For Year GENERAL INSTRUCTIONS This exemption applies to freeport goods as governed by Texas Constitution Article VIII Section 1-j and Tax Code Section 11. 251 01/2013 Additional Important Information for Completing Form 11. 251 -...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign harris county tax office houston tx form

Edit your harris county appraisal district property search form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax form texas form via URL. You can also download, print, or export forms to your preferred cloud storage service.

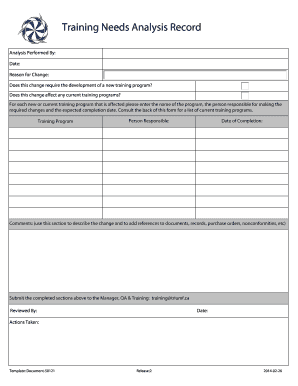

How to edit harris county texas tax office online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit harris county tax office forms. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out harris county tax office form

How to fill out TX 11.251

01

Obtain the TX 11.251 form from the Texas Department of Family and Protective Services website or your local office.

02

Fill in your personal details, including your name, address, and contact information at the top of the form.

03

Indicate the purpose of the form by checking the relevant boxes pertaining to the services or benefits you are applying for.

04

Provide necessary details about your household, including the names and ages of all members.

05

Fill out any financial information requested, including income sources and expenses.

06

Review the form for completeness and accuracy to ensure all required sections are filled out.

07

Sign and date the form at the bottom to verify the information provided is true and correct.

08

Submit the form by mailing it to the address specified on the form or deliver it in person to your local office.

Who needs TX 11.251?

01

Individuals or families in Texas seeking benefits or services from the Texas Department of Family and Protective Services.

02

Persons who need assistance related to child welfare, financial support, or other related services provided by the state.

Fill

harris county tax office houston texas

: Try Risk Free

People Also Ask about gift deed form texas

How do I get a tax exempt number in NC?

Contact the Taxpayer Assistance and Collection Center at 1-877-252-3052 (toll-free) or fax your request to (919) 715-2999. Include in the request, your name or company name, address, telephone number, and exemption number.

How do I get property tax exemption in South Carolina?

Most property tax exemptions are found in South Carolina Code Section 12-37-220. For any real property exemptions taxation is a year in arrears, meaning to be exempt for the current year, you must be the owner of record and your effective date of disability must be on or before December 31 of the previous year.

How to get a sales tax exemption certificate in North Carolina?

North Carolina does not require registration with the state for a resale certificate. How can you get a resale certificate in North Carolina? To get a resale certificate in North Carolina, you may fill out the Streamlined Sales and Use Tax Agreement Certificate of Exemption Form (Form E-595E).

At what age do you stop paying property taxes in South Carolina?

What is the Homestead Exemption benefit? The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.

How do I apply for local property tax exemption?

If you have already submitted an LPT Return and did not claim an exemption that you were entitled to, you should contact the LPT branch.How to claim an LPT exemption your name. your Personal Public Service Number (PPSN) your property ID. your property address. and. relevant information to support your claim.

Do you have to apply for homestead exemption every year in Florida?

All homestead exemption applications must be submitted by March 1. Do I need to reapply for a homestead exemption every year? No. We will renew your homestead exemption annually as long as you continue to qualify for the exemption.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get texas inventory and appraisement form?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific harris county tax office houston address and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for signing my harris county texas property tax bill in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your harris county property tax bill and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit harris county appraisal district on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share harris central appraisal district property search on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is TX 11.251?

TX 11.251 is a form used in Texas for reporting franchise tax information.

Who is required to file TX 11.251?

Businesses that are subject to Texas franchise tax and are classified as a taxable entity are required to file TX 11.251.

How to fill out TX 11.251?

To fill out TX 11.251, businesses need to provide their entity information, revenue amounts, deductions, and other relevant financial data as outlined in the form's instructions.

What is the purpose of TX 11.251?

The purpose of TX 11.251 is to report the financial status of a business entity for the purposes of calculating and assessing franchise tax in Texas.

What information must be reported on TX 11.251?

TX 11.251 requires reporting of the entity's name, address, revenue, deductions, the total amount of tax owed, and any other information specified in the form.

Fill out your TX 11251 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Inventory And Appraisement Form Harris County is not the form you're looking for?Search for another form here.

Keywords relevant to tx harris county tax collector

Related to harris county civil process request form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.